CONTACT US

Do you have any further questions? How can we help you? Get in touch with us.

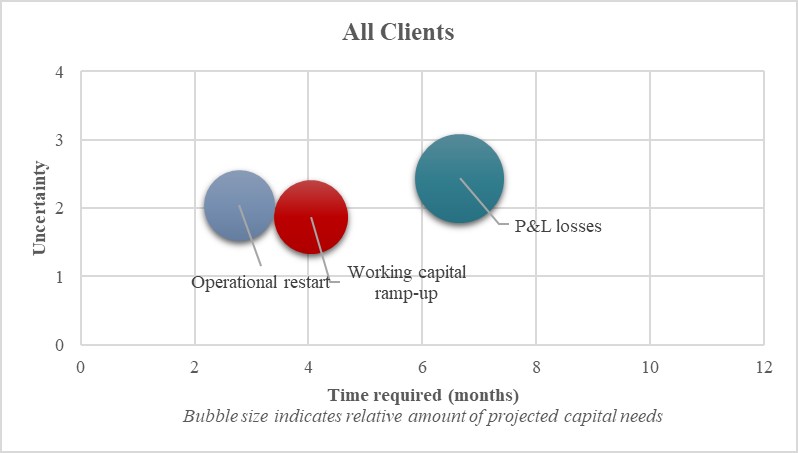

CR3 Partners’ clients and referral sources agree that additional capital will be needed to return operations to the “new normal” after COVID-19. But how much capital will they need, where will it be deployed, and who will provide it? Barak Tulin surveyed his CR3 colleagues on their work for clients during COVID-19 and found that the highest proportion of capital is projected to be allocated not to building accounts receivable and inventory, but rather to funding long-term P&L losses. Will secured lenders fund those losses, and if not, who will?

“A full recovery is unlikely until people are confident that it is safe to re-engage in a broad range of activities.” –Jerome Powell, Chairman of the Federal Reserve, in testimony delivered on June 30, 2020

As companies return their operations to the post-COVID “new normal,” how much capital will they need, where will they allocate it, and who will provide the funding to get these companies back to business in an uncertain economic environment?

CR3’s recent conversations with clients and referral sources suggest they are thinking seriously about these questions. While they generally agree that returning to post-COVID operations will require more capital than was needed to manage operations during COVID, there is less agreement on how much capital they will need, how they will allocate it, and how long they will need it.

Once those questions are answered, companies then need to determine who will provide that capital. If companies cannot sufficiently change their economic models to operate profitably below pre-COVID revenue levels, will senior lenders, subordinated lenders, or private equity sponsors provide the capital to help them restart their businesses and sustain P&L losses for possibly the next one to two years?

To provide initial answers to these questions, CR3 surveyed our own partners about their clients’ projected capital needs as they return to post-COVID operations. The survey addresses three uses of capital that companies will need to raise from outside sources if they cannot fund them through operational improvements:

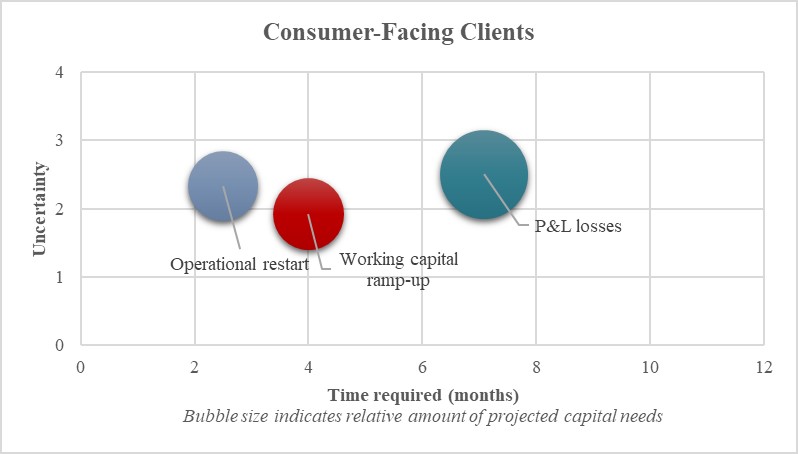

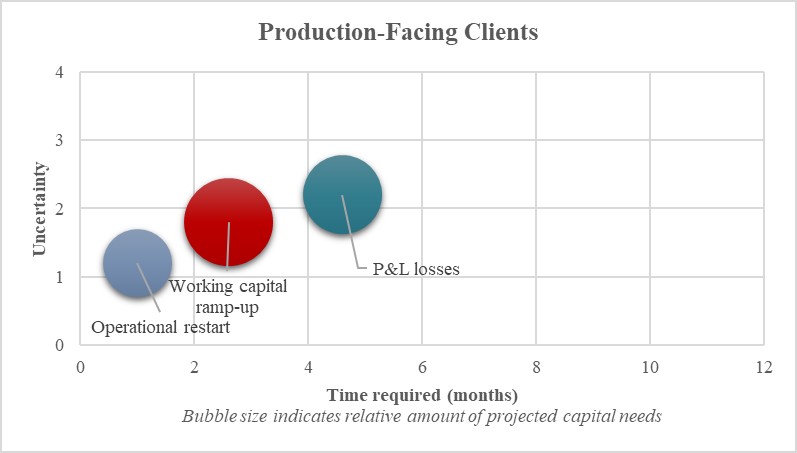

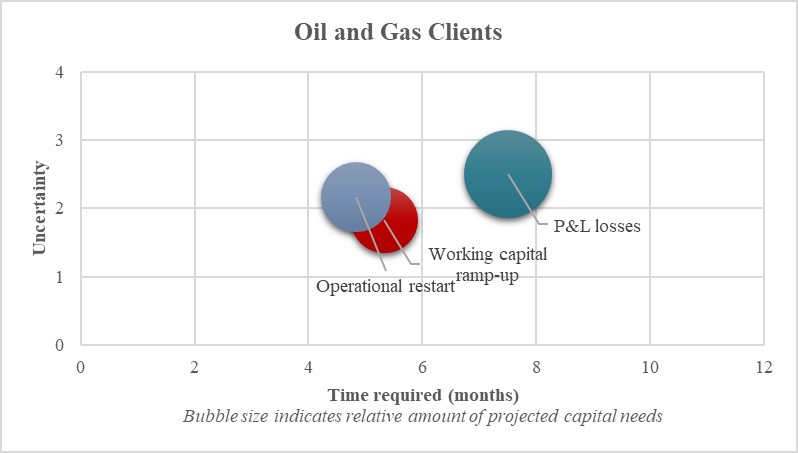

We classified our clients into three broad industry groups: consumer-facing clients, which sell directly to consumers or whose demand is closely correlated with consumer activity; production-facing clients, whose revenue is a function primarily of industrial activity; and oil and gas clients, which are analyzed separately due to their industry-specific economic models and their outsized dependence on commodity prices.

The survey results, which we discuss in detail below, yield the following key insights:

The consumer-facing clients represented in our survey consist of restaurants, retailers, food and beverage providers, and consumer-oriented service companies. The partners managing these client engagements project the highest amount of capital to be dedicated to P&L losses that will last an average of seven to eight months post-COVID, along with a relatively high uncertainty around the amount of P&L losses. Although the explanations vary by client, most of these projected losses are due to economic uncertainty that may drive consumers to defer or reduce purchases; potential changes in consumer behavior due to extended periods of social distancing, which could lead to reduced out-of-home purchases; and high fixed-cost burdens, especially in restaurants and retail, which make these clients particularly sensitive to revenue reductions. Working capital ramp-up has a significant but lower projected allocation because although inventory build and the payment of expenses deferred during COVID need to be funded, the impact of growth in accounts receivable is minimal due to the shorter average days of sales outstanding at clients that sell directly to consumers.

The production-facing clients in our survey operate in construction, industrial manufacturing, and packaging, and their revenues are driven more by industrial activity than by consumer demand. These clients’ engagement partners project the largest proportion of capital to be allocated to working capital ramp-up, which is due mostly to building raw-material inventory and investing in accounts receivable as revenue increases. P&L losses are projected to require less capital, and last for a shorter period of time, than for our consumer-facing clients due to the relatively higher proportion of variable costs at production-facing clients and the operational improvements CR3 helped them implement during COVID.

The survey results for CR3’s oil and gas clients pose four analytical challenges. First, the capital profile changes based on whether a client operates in the production segment or the services segment. Second, within the production segment, capital needs depend on whether producers operate onshore or offshore, as well as the stringency of environmental regulations in the states where the producers operate. Third, although significant capital allocations toward operational restart may be needed as companies return their operations online, none of our clients has been shut-in, and therefore these costs consume a smaller-than-expected proportion of total capital needs. Finally, the distress in oil and gas that continued into 2020 was exacerbated primarily by the first quarter price war between Russia and Saudi Arabia and secondarily by reduced demand for refined products as a result of COVID-19.

Taken together, CR3’s oil and gas clients project to allocate the largest proportion of their capital needs toward funding P&L losses, which on average range between six and eight months but in some cases could last as long as 12 months. Because these clients have high fixed-cost hurdles, the projected slow rebound in petroleum prices creates a higher amount and longer duration of projected P&L losses. At our clients in the services segment, these projected losses are compounded by the possibility that their own customers will undergo further distress and file for bankruptcy in the next several months. The lack of predictability of petroleum prices is also driving respondents’ relatively high uncertainty rating of P&L losses in the oil and gas segment.

Now that we have identified from our survey sample the relative amount of each capital need, the uncertainty in calculating those needs, and the time period during which those needs will require funding, one final question remains: who will provide the capital?

During COVID-19, we have helped our clients meet their capital needs by reducing costs and pivoting toward leaner operations; navigating their application process for PPP funds, as well as helping prevent their creditors from garnishing those funds; and negotiating with their lenders to work collaboratively with our clients while they plan their post-COVID future. But now that many of our clients are preparing to return to the post-COVID new normal, and given that they will likely require significant capital to be allocated toward funding long-lasting P&L losses, how will secured lenders respond?

First, our clients that project a relatively high capital allocation for working capital ramp-up should generally expect to have near-term support from their secured lenders, all else being equal. As accounts receivable and inventory in the working capital ramp-up are typically part of these lenders’ collateral package, secured lenders are likely to work more constructively with those clients as their businesses restart.

Second, our clients with a high capital allocation toward operational restart will likely have a more difficult time gaining concessions from their secured lenders, who typically expect one-time costs to be offset either by the company’s efforts to reduce costs elsewhere or by incremental funding from junior capital. Companies that are projecting high restart costs should first make greater efforts to improve their P&L performance in order to offset these short-term costs with long-term operational improvements. If those efforts are not sufficient, are uncertain, and/or take an extended time to bear fruit, companies may need to seek additional junior capital to support near-term liquidity.

Finally, companies with long-term P&L losses, and a high proportion of capital allocated to funding them, could create significant problems for their secured lenders. As it is typically outside secured lenders’ mandate to fund operating losses – and all the more so when the losses are as long-lived and uncertain in amount as our survey results suggest – these lenders may find themselves choosing among the lesser of three evils for their borrowers and themselves:

The COVID-19 pandemic unleashed rapid and unprecedented distress all over the world, and particularly to CR3’s clients. Since that time, we have made significant efforts every day to help our clients negotiate with their constituents, improve their operations, and plan their recovery to the post-COVID new normal. However, we also recognize that emergence will be likelier to succeed if our clients are prepared to work in collaboration with their capital sources, who in many cases will need to stretch outside their normal mandates to support their borrowers, as our survey results indicate. While we help our clients fix their operations and work collaboratively with their capital providers, all of us at CR3 continue to look forward to the day when the heroic efforts of our medical professionals, essential workers, and first responders turn COVID-19 into a distant memory.

CR3 Partners, LLC is a national turnaround and performance improvement firm that assists, guides and collaborates with management teams and their constituents facing any sort of transition, stress, or distress. Barak Tulin, a Partner in CR3’s New York office, wrote this article based on survey results provided by the full partnership. Jeff Armstrong and Dennis Gerrard, Partners in CR3’s Atlanta office; James Katchadurian, a Partner in CR3’s New York office; Tim Skillman, a Partner CR3’s Los Angeles office; and Ashtynn Baltimore, a Senior Associate in CR3’s Los Angeles office, contributed additional research for this article.

Do you have any further questions? How can we help you? Get in touch with us.