CONTACT US

Do you have any further questions? How can we help you? Get in touch with us.

There’s a difference between steady state management and change agents. A great steady state management team can execute an operating plan every day with precision. They can do the same over and over, never deviating from the defined process. Management disciplines such as Six Sigma are designed to support these teams by minimizing variation, thereby increasing efficiency. Building the type of team that can execute with continued precision is difficult and oftentimes these teams cannot react to deviations in the process. Deviations from a defined process can create conflict in an organization that is dedicated to staying the course. The team may resist making wholesale changes and will instead make small revisions to improve the process, though many times this turns into an exercise in micro-incrementalism. Employees in an organization that advocate change can be marginalized to reduce tension.

Every company will eventually face internal or external pressures requiring them to pivot. It is hard to imagine a company the size of Amazon would have to undergo a major change but even Jeff Bezos in 2018, during an all-hands meeting in Seatle, told his employees, “I predict one day Amazon will fail. Amazon will go bankrupt. [1]” His goal is to delay the inevitable.

In cases like these, a great steady state management team needs to be augmented with a change agent. A Chief Restructuring Officer (CRO), sometimes referred to as a Chief Strategic Officer, is a change agent tasked with helping the team address deviations. The CRO is usually brought in by stakeholders in the capital stack – people who have money to lose.

Most companies are managed by a C-suite that includes a CEO, CFO, COO, CIO, and others. Each function reports to the CEO, the orchestrator of the operating plan. The owners, represented by the Board of Directors, set the strategic goals along with the C-suite. The role of the CRO is to drive change in the organization. The CRO reports to the Board of Directors along with the CEO. The CRO at times can be seen as the copilot of the organization – the CEO keeps the plane flying while the copilot figures out how to fix it. The CRO is meant to be a temporary part of the team. In a steady state, the existing management team and processes work, making the CRO an unnecessary expense.

Unfortunately, many of the companies we work with have less than 3 weeks of cash. Their options may be limited, but action must be taken swiftly. The sooner change can be implemented, the more runway there is to see the results. Teams, including capital sources, that are reluctant to pivot can delay the change agent’s decisions until the results are untenable, usually an inability to pay bills as they come due.

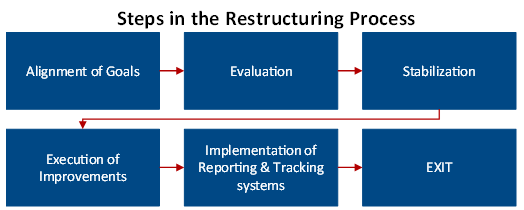

Effective turnaround engagements are a defined process and an ongoing one. To be effective they must be immediately impactful.

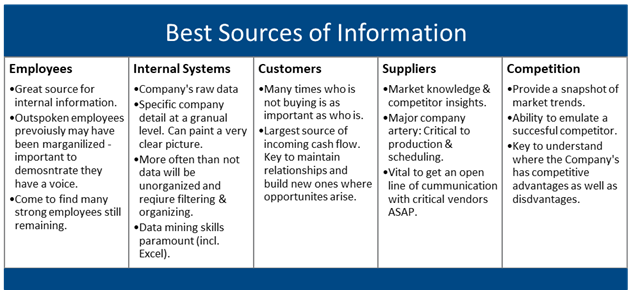

Most companies must shrink first by implementing cuts so they can return to profitability and then grow to prosperity. This process involves intense data mining to determine core products, customers, and locations. Data mining is a critical component of the evaluation phase, and most companies today have a wealth of data in their ERP systems as compared to systems from decades ago. Unfortunately, while the data may exist, companies often can’t access it or get it into a form that is usable. For the CRO team, the ability to evaluate a company’s records is a critical step in the process and the CRO team needs to include the skills to mine and analyze the data.

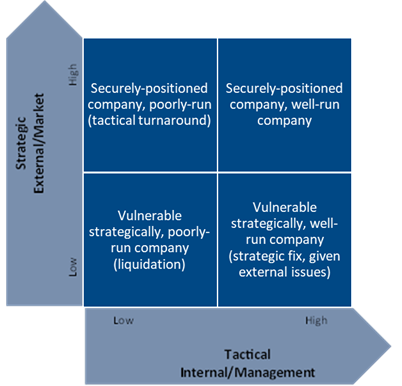

The evaluation phase concludes with a report to the board and stakeholders regarding the steps and capital needed to complete the turnaround. The evaluation always contains alternatives based on capital and resources available to complete the transformation. A competent management team that can execute the plan is a major, necessary component, although contract supplemental professionals can bridge the gap until permanent management is found. If sufficient capital is available, a restructuring is usually preferable to maximize value. All too often, the capital required cannot be raised and the assets are sold to another entity that can capitalize on the “live pony.” In rare circumstances, the best option is a total liquidation where there is no strategic reason for the assets to go forward as a going concern. All options are weighed during restructuring, as any process that does not allow any points of failure is doomed. This is especially true when outside forces must cooperate to be successful. The plan should be documented with responsibilities, milestones, and contingencies so that the team knows who is responsible for each action and can pivot quickly if necessary.

Immediate restructuring steps are generally taken in the evaluation process to stabilize the company. For example, cutting product lines or selling excess inventory. These actions can end up strategic in nature when they were originally tactical decisions to live another day. Much like the work of an emergency room doctor performing an amputation, the patient is saved although the rest of their life is affected by the steps taken.

Operational changes are much harder to execute than most realize. Often, processes have been in place for decades and have become part of the culture. Additionally, these processes may have seemingly worked for decades but were either impacted by a sudden change or a change so slow that management lost sight of it. Getting alignment from employees, customers, and suppliers can be difficult as these constituents may be distrustful of the change or the CRO. Most often though, a sudden pivot is necessary to preserve capital, making alignment of goals and empowerment of the CRO imperative. The objective eyes of the CRO can help make these quick decisions. A CRO should be mindful of their temporary position and work to build support for change within the organization.

Once the improvements are executed and operations are fixed, a robust reporting system must be implemented to track successes and to serve as an early warning system. The Board of Directors and management must identify the key issues that are fundamental to the organization and how to track them. If the processes are not tracked and employees held accountable, they tend to revert to prior practices, particularly after the CRO disengages. The company drifts back to prior practices and fails again. The management team must be committed to the new way of operating.

Turnarounds are much faster than most people realize. Most client engagements last about six months. It takes 4-6 weeks to assess the issues, 2-4 months to affect the change, and 2-4 months to ensure the change is working and the company is set up to continue the new processes. Turnarounds at larger organizations can take longer but will follow the same steps. Pilgrim’s Pride, a CR3 Partners customer, was an $8B sales company and the entire restructuring process was only one year, while Furr’s Cafeterias was implemented in four weeks.

Change is inevitable and even great management teams can fail in addressing it. The CRO is a partner to management, helping them navigate the change, and driving meaningful and lasting improvements. The sooner the change agent can join the team, the higher the chances of a successful turnaround.

CR3 Partners, LLC is a national turnaround and performance improvement firm that assists, guides, and collaborates with management teams and their constituents facing any sort of transition, opportunity, stress, or distress. William Snyder is a Partner based in Dallas. Carmen Barrett is a Director based in Dallas. Cody Clarke is a Manager based in Chicago.

[1] CNBC: https://www.cnbc.com/2018/11/15/bezos-tells-employees-one-day-amazon-will-fail-and-to-stay-hungry.html

Do you have any further questions? How can we help you? Get in touch with us.