CONTACT US

Do you have any further questions? How can we help you? Get in touch with us.

Restructuring professionals wear many hats while executing a turnaround. They need to be skilled in finance, marketing, operations, human resources, and other areas. A strong turnaround professional is not only competent in these areas, but also knows when to leverage others. In addition to functional business knowledge, the ability to understand the unique aspects of various industries is key.

Most turnaround professionals work to become experts in certain industry verticals to maximize efficiency and effectiveness. Using the varied skills required in any situation helps professionals refine their toolkit for a specific type of business because each business represents a unique set of challenges.

Consider a multi-unit franchise restaurant business. While not unique to the industry, specific issues to consider include marketing and brand management, customer experience, employee training and retention, pricing and menu management, capital expense management, lease and footprint analysis, vendor relations, and the franchise/franchisee relationship, among others.

At the start of any restructuring assignment, it is critical to follow some key steps to ensure the highest probability of success. But first, decide if the business is worth saving. Sometimes the best path may not be a turnaround but a wind-down or shut down.

Create a comprehensive restructuring plan that outlines specific goals, strategies, and timelines. The plan should address key areas such as cash flow management, financial restructuring, operational improvements, marketing and branding, cost reduction measures, human resources, and others. Some common pitfalls during a process that need to be considered during planning include:

Lack of focus on areas with the most cash potential.

Too complicated – too many initiatives, unclear priorities. Keep it simple.

Taking short-term gain actions that undermine long-term business health.

Insufficient resources dedicated or allocated too slowly.

IT requirements neglected until too late.

Lack of transparency in tracking progress and results – hiding problems.

In the case of a restaurant franchise operator, one must conduct a thorough analysis of the franchise’s current financial state, including unit-level cash flow, profitability, debt obligations, real estate, and operational inefficiencies. Identify the root causes of distress and areas that require immediate attention. Get to know your company employees and learn who can be relied upon to help manage and execute the plan.

Quickly gather relevant data and implement reporting mechanisms to track financial and operational metrics. Continuously evaluate the effectiveness of implemented changes and make necessary modifications.

Maintain open and transparent communication with franchisees, employees, lenders, suppliers, and other stakeholders throughout the restructuring process. Keep them informed about the progress, challenges, and expected outcomes. Building trust and support among stakeholders is crucial for successful restructuring.

Continuing with the restaurant franchise example, the following are some common areas of focus.

13-week cash flow analysis: Above all, be sure to understand the available cash and whether there are quick wins by pulling certain levers. Can a group of vendors be negotiated with to spread out a fixed payment plan to minimize unpredictable outflows? Can interest be deferred for a period? Find the low hanging fruit and act decisively. Do the math immediately to help uncover leakage and develop strategies.

Four-wall economics: It is necessary to understand the portfolio of the company based on profitability and average unit volume (AUV). Where is the stress coming from? Is it a general geographic location, older stores, a group of habitual poor performers, short term cost spikes, or mid-level management issues? Are there poorly performing stores with soon-to-be expiring leases that can be closed? Can labor be consolidated to lower cash burn while leveraging higher performers? Use the power of data analysis to understand the portfolio.

Menu and product offering: Can higher volume products absorb a small price increase? Can lower cost products be promoted more aggressively? Does an item that represents 2% of sales require fifteen different vendors to create when the average product takes seven? This may not be relevant for a franchise operation but is an example of how to streamline vendors and lower waste.

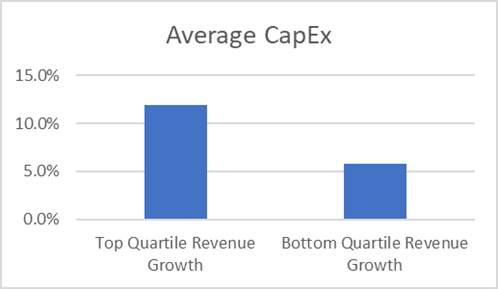

Capital expense plans: Do not ignore capital requirements. It is proven that updated locations produce higher revenues. CapEx can mean real estate, equipment, or technology - but more spending translates to higher revenues. Although cash may not be readily available during a turnaround (in fact it is likely a big reason why the business needs to be restructured), don’t leave this out of the planning and cash flow forecasting. Restaurants achieving higher growth invest in CapEx more than two-to-one.

Figure 1: U.S. publicly-traded restaurants revenue growth and Capex to revenue for 2012-2017[1]

Franchise agreements: Always include the franchisor in the process. Some are more challenging than others, but they can be a source of support either operationally or financially.

Landlords: Since geographic dynamics change over time, the retail footprint and lease obligations should be reviewed to ensure the economics on a unit-level basis make sense.

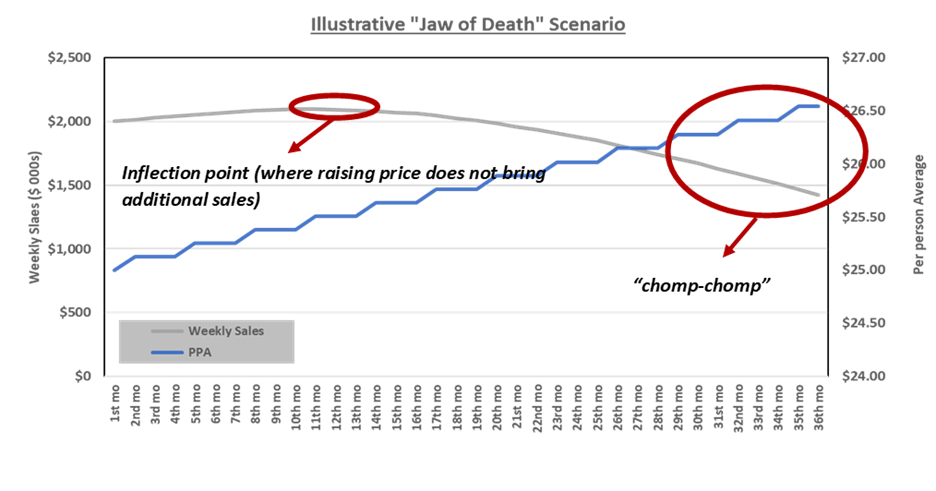

Pricing and cost review: Review all costs and understand peer level benchmarks including labor, food/beverage/paper, rent, and overhead. Identify opportunities to reduce costs without compromising quality or customer experience. Watch out for the “jaws of death”, which is a concept that CR3 Partners’ Sugi Hadiwijawa often describes. This occurs when prices are raised at the expense of total sales due to a loss of customers that no longer see the value.

Figure 2: Illustrative “Jaws of Death Scenario by CR3 Partners’ Sugi Hadiwijaya

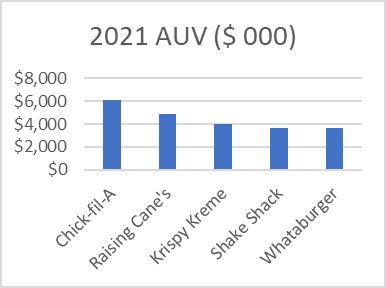

Restaurant operators should avoid ineffective marketing strategies, such as relying solely on word-of-mouth or failing to engage with customers on social media. A strong online presence, regular promotions, and creative marketing campaigns can help increase customer engagement and attract new customers. Know your customers and market to them. Whatever your opinion on the subject, do not make the “Anheuser-Busch mistake.” Customers are the lifeblood of any business, and poor customer service can quickly drive them away. Restaurant operators must prioritize customer service and ensure their staff is adequately trained to provide an exceptional customer experience. This includes being friendly, attentive, and responsive to customers’ needs and complaints. Keep your restaurant clean to provide your customer with a welcoming place to visit. Regular training and feedback can help improve customer service and ensure customers have a positive experience. Chick-fil-A makes customer service a priority - anyone who has visited can understand. Chick-fil-A continues to lead in customer satisfaction and average unit volume year over year.

Figure 3: Customer Satisfaction Index[2] Figure 4: Average Unit Volume[3]

Given the service nature of a restaurant franchise business, employees are key to success and require a significant amount of attention. Assess the current staffing structure and evaluate whether any adjustments are required both at the field level and the management level. Leverage high performers to assume larger and new roles. Quickly determine who can be trusted and relied upon at the company as staff are typically uncertain or scared of the process during a turnaround. It’s no surprise that the best performers are usually the first to leave. Coach them on the process and let them know they are learning a new and valuable skill. If necessary, make it worth their while to stay through incentives. Provide appropriate training for all employees and support them to ensure they are aligned with the restructured goals and equipped with the necessary skills to deliver improved performance. Focus on steps to enhance employee morale, including:

Recognition and appreciation: Acknowledge and appreciate employees’ hard work and achievements regularly. Recognize their contributions through emails, team meetings, or an employee recognition program. Personalized and specific recognition can go a long way in boosting morale.

Open and transparent communication: Foster a culture of open and transparent communication. Regularly share information about company goals, achievements, and challenges. Encourage employees to provide feedback, ask questions, and express their ideas and concerns.

Employee development and growth: Invest in the professional development of your employees. Provide opportunities for training, workshops, conferences, and mentorship programs. Encourage employees to set goals and help them progress in their careers.

Work-life balance: Promote work-life balance by offering flexible work arrangements, such as remote work options or flexible schedules. Encourage employees to take breaks, vacations, and time off when needed. Support a healthy work-life integration to reduce burnout and increase morale.

Team building activities: Organize team-building activities and social events to foster a sense of camaraderie and connection among employees. These activities can include team lunches, off-site outings, volunteer work, or sports events. Building positive relationships among colleagues improves morale.

Empowerment and autonomy: Provide employees with a sense of ownership and autonomy in their work. Trust them to make decisions and allow them to have input into projects and processes. Empowered employees feel valued and motivated.

Fair compensation and benefits: Ensure that employees are fairly compensated for their work and provide competitive benefits packages. Regularly review salaries to stay aligned with industry standards. Offering benefits like health insurance, retirement plans, and flexible spending accounts can also improve morale.

Positive work environment: Foster a positive work environment by encouraging teamwork, collaboration, and respect among employees. Address any issues promptly and ensure a safe and inclusive workplace that values diversity.

Opportunities for creativity and innovation: Encourage employees to share their ideas and suggestions for process improvements or new initiatives. Create a culture that supports innovation and rewards creative thinking.

Celebrate milestones and achievements: Celebrate milestones, project completions, and individual or team achievements. This can be done through small gestures such as team lunches, recognition awards, or even handwritten notes of appreciation.

Every situation will have a unique set of facts that contribute to the need for restructuring, but every project will benefit from considering these strategies, which will help provide a roadmap for a successful outcome.

CR3 Partners, LLC is a national turnaround and performance improvement firm that assists, guides, and collaborates with management teams and their constituents facing any sort of transition, opportunity, stress, or distress. David Tiffany is a Partner based in CR3 Partners’ Los Angeles office.

[1] Aaron Allen & Associates: https://aaronallen.com/blog/restaurant-capex

[2] Statista: https://www.statista.com/statistics/194988/customer-satisfaction-with-us-limited-service-restaurants-since-2006/

[3] QSR Magazine: https://www.qsrmagazine.com/content/qsr50-2021-top-50-chart

Do you have any further questions? How can we help you? Get in touch with us.