Managing Working Capital Collateral for Asset Based Revolvers

Asset Based Revolving loans (ABL revolvers) are commonly used by companies to finance working capital needs. These revolving loans are secured against current assets such as accounts receivable, inventory, and occasionally machinery and equipment. The collateral value of a company’s working capital assets is certified through a borrowing base certificate, at predetermined intervals (e.g. monthly, weekly, etc.), which is an official document that outlines the maximum loan amount a lender is willing to provide to a company based on that collateral.

Collateral Value of Working Capital Assets

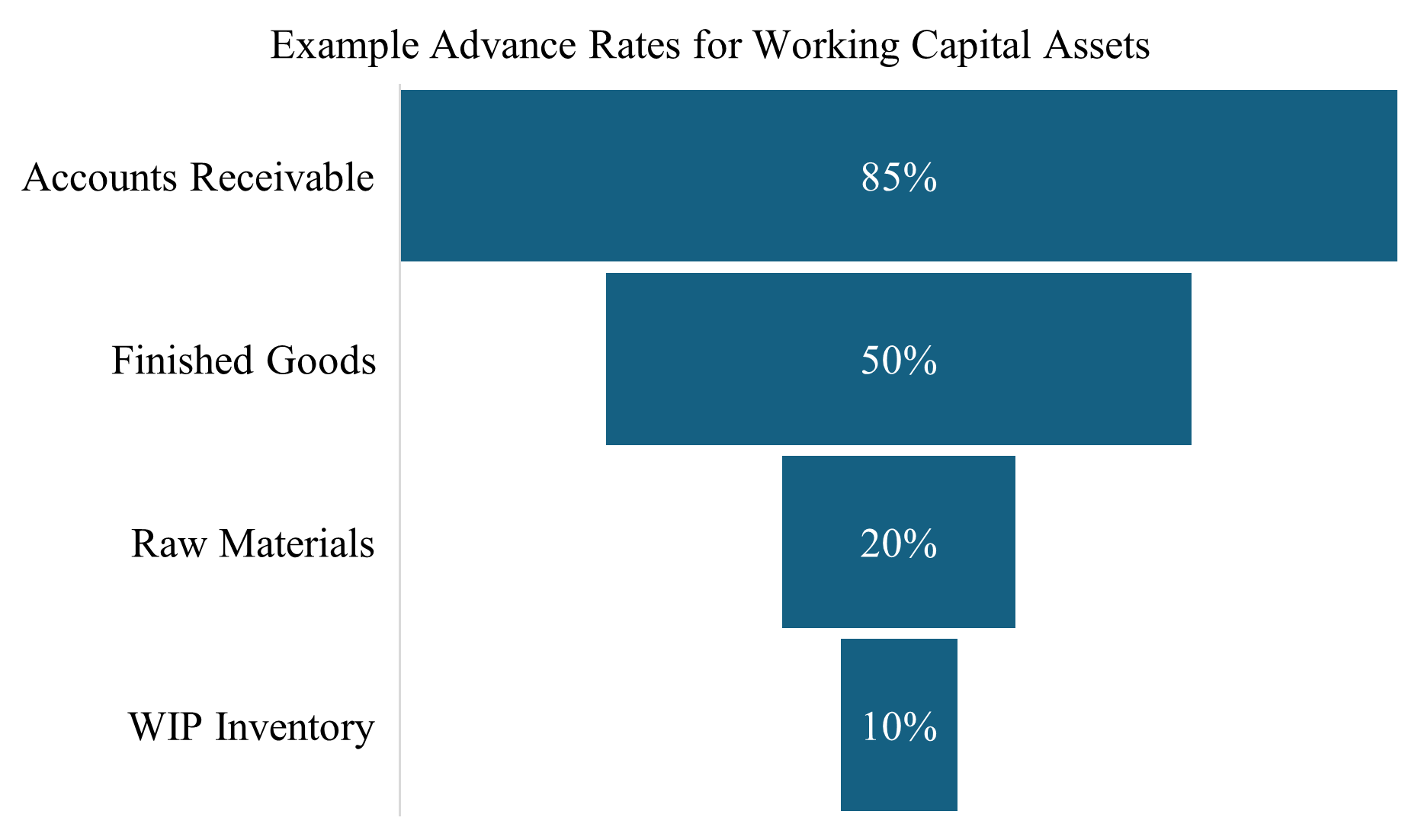

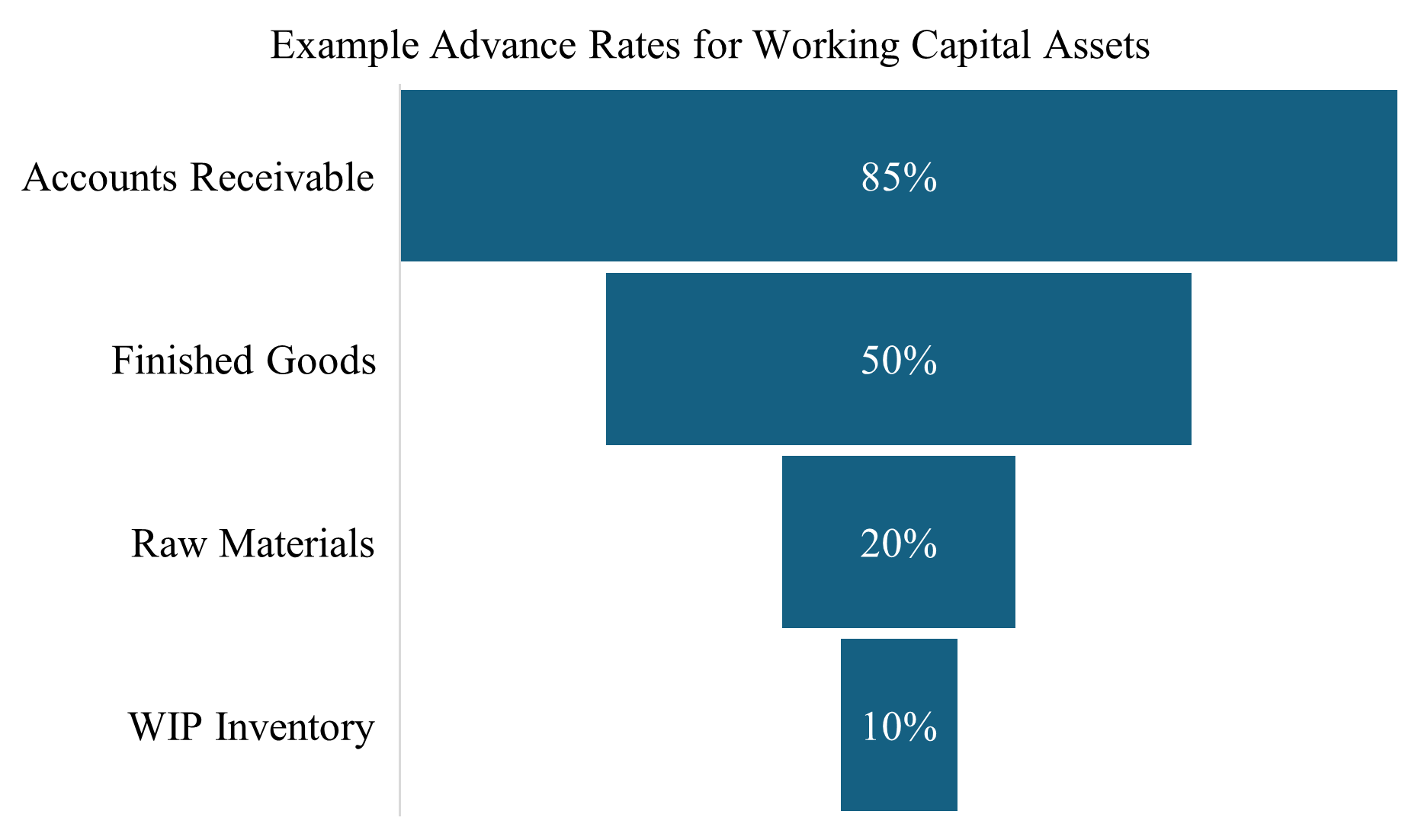

The collateral value of a company’s working capital assets is determined by the liquidity of the assets; the value is based on how quickly the asset can be converted into cash. The higher the liquidity, the higher an advance rate a lender is willing to offer. The advance rate is the percentage of the underlying collateral asset value that a lender will loan against. Accounts receivable are often the most liquid of these assets and as a result typically carry the highest advance rates. Inventory also plays a role in collateral values. Inventory that is finished and immediately shippable tends to carry the highest inventory-related advance rate, as it is the most liquid. The advance rate decreases for work-in-progress inventory (WIP) and raw materials, as they will take longer to be converted into finished goods and, ultimately, cash.

The conversion of accounts receivable, finished goods, WIP inventory, and raw materials to cash is crucial to a company’s longevity. Mismanagement of current assets can lead to cash shortages, even in otherwise profitable companies. When a company faces financial distress, they will often ask the lender to increase the advance rates on its revolver. Lenders typically reject such requests, further exacerbating the liquidity shortfall. In fact, in a default situation, lenders typically reduce advance rates to protect their position, taking reserves, and often imposing additional blocks against the borrowing base. In such cases, the borrower must find alternative ways to create liquidity as the lender will not intervene to rescue the distressed company.

Effective Management of Working Capital Assets

The following steps are essential for effectively managing working capital collateral for revolvers.

Step 1: Audit the Borrowing Base

The first step in managing working capital is ensuring the accuracy of the borrowing base. Our firm has often found millions of dollars in discrepancies due to issues like incorrectly aged accounts receivable, improperly valued inventory, untimely inventory additions, lack of understanding or planning for inventory valuation changes, or incorrect offsets. These errors can significantly diminish the value of the borrowing base.

Let’s consider a fictitious seafood processor as an example. According to GAAP, inventory is to be carried on the books of the borrower at a lower cost or market value. This is also the case with lenders. In a declining market, the value of inventory can decrease, causing the borrower to mark inventory to a lower value, reducing availability of borrowing against that inventory. This may cause the borrower to be out of compliance or in an overadvance situation with the lender. In this case the lender will ask the borrower to come back into compliance, which may require selling inventory at depressed values, a liquidity infusion of cash, or pledging additional assets to the borrowing base. Performing a “mini audit” before the lender conducts its review can help identify and correct these discrepancies, building credibility with the lender and helping to avoid the need for a more intrusive field audit.

Step 2: Address Ineligible Assets

The borrower must address ineligible assets, which are assets excluded from the borrowing base and not eligible to be advanced on. Common examples include aged receivables (often over 90 days past due), receivables concentrated with a single customer, and outdated or obsolete inventory. In situations where liquidity is limited it is essential to focus on managing cash flow rather than the income statement. If the company is already in default, a plan should be developed that frees up cash by addressing these ineligible assets.

As an example, collecting overdue accounts receivable or selling ineligible inventory can quickly generate cash. In some cases, a candid conversation with a customer regarding overdue payments may improve cash flow. Holding onto slow-moving or obsolete inventory to avoid a write-off only worsens the situation. If facing default, it is best to find a way to sell inventory to generate cash. Although packaging and supplies are typically excluded from the borrowing base, companies can collaborate with vendors to warehouse these items and provide them on a just-in-time basis, freeing up valuable working capital.

Step 3: Focus on Inventory Management

Inventory management often presents the largest opportunities for cash gains and improvement, primarily because their advance rates are much lower than those of accounts receivable. It is common for lenders to offer advance rates of around 50% on finished goods inventory, meaning the borrower needs to produce the other 50% in cash when it is needed. Additionally, it is common for borrowers to impose a sub-limit on inventory to induce the borrower to manage inventory and not carry too much. For example, on a $100MM revolving ABL, there may be a $50MM sub-limit of availability on finished goods inventory. If the borrower has $120MM of finished goods inventory, an advance rate on finished goods inventory of 50%, and the borrower is subject to a $50MM sub-limit, there is $20MM of finished goods inventory that the borrower cannot borrow on. Remember that this inventory is carried at the lower of cost or market value. In this example it may make sense for the borrower to sell the excess $20MM of finished goods inventory - even at cost or at a loss - to generate liquidity for the business. This may lead to losses that will be reflected in the income statement, however in tight liquidity situations cash is more valuable than maintaining a profit margin.

For manufacturers, the potential for gains is even greater, as advance rates on work in process inventory (WIP) and raw materials are usually much lower than on finished goods. Advance rates might be as low as 20% for raw materials, 10% for WIP, and then rise to 50% for finished goods. Once the finished goods are sold and converted to accounts receivable, the advance rate can jump to 85%.

The progression from raw materials, to WIP, to finished goods, to accounts receivable can result in a dramatic increase in liquidity and borrowing capacity. For example, look at a standard bill of materials and assume a product sells for $100.

For this example, the following assumptions apply:

- Raw materials are 40% of the sales price

- WIP is 50% of the sales price

- Finished goods are 70% of the sales price

- AR is 85% of the sales price

Lenders are willing to advance:

- 20% on raw materials

- 10% on WIP

- 50% on finished goods

- 85% on accounts receivable

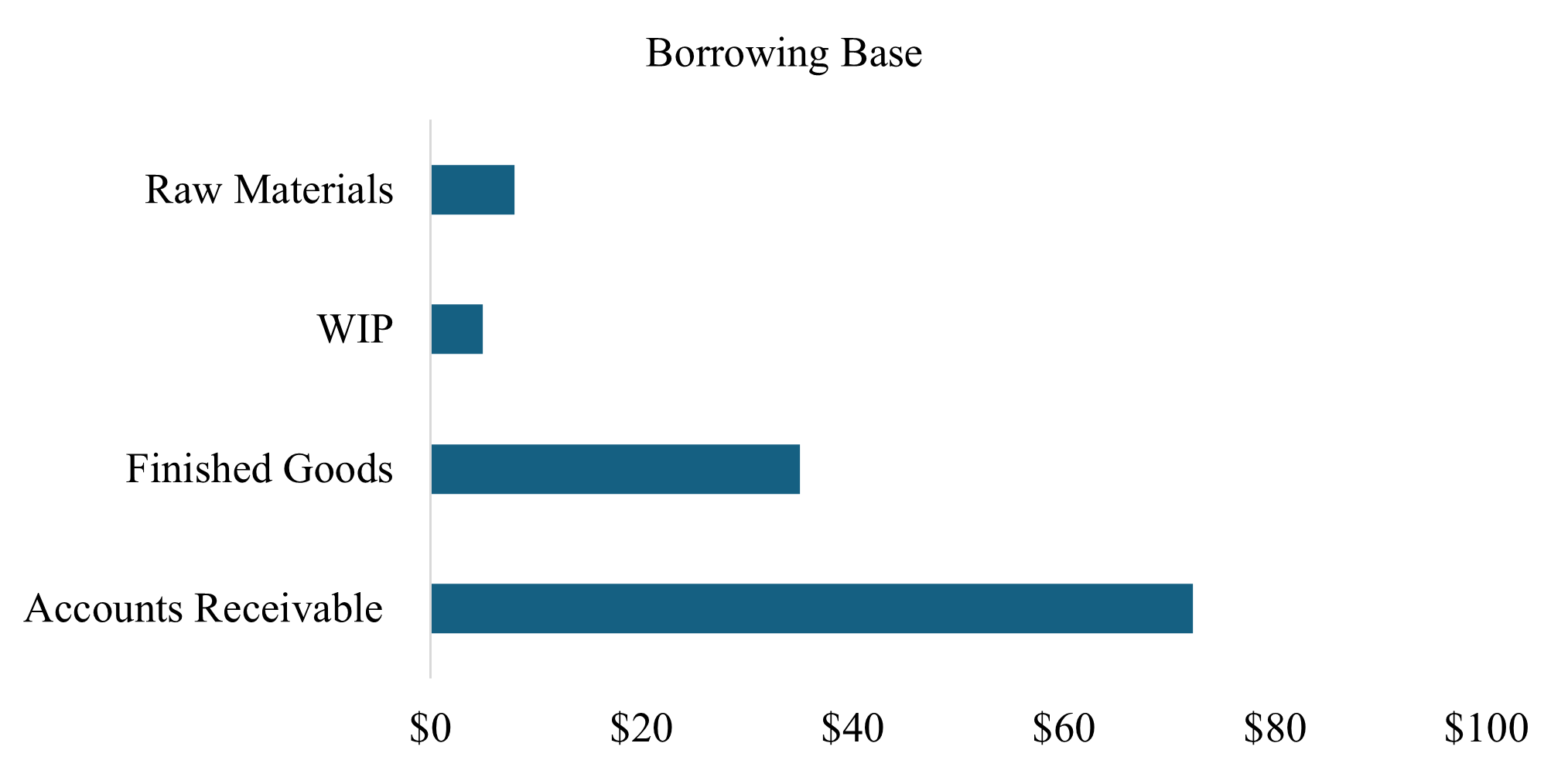

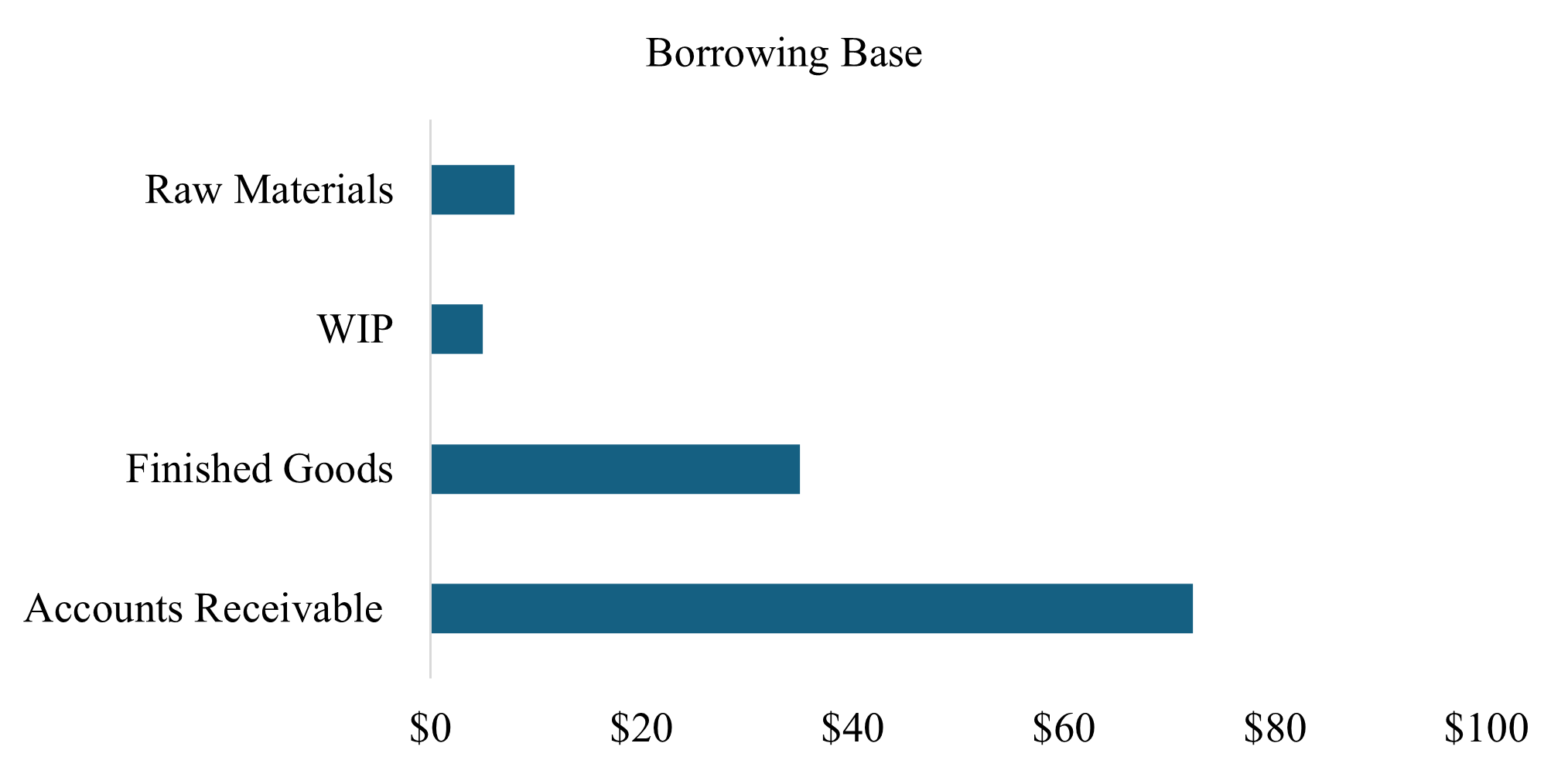

Based on the above, the chart below illustrates how the borrowing base increases at each stage of the production and sales cycle:

As the product moves through production and into sales, its costs and value increase.

- Raw Materials: We begin with $40 of raw materials (40% of the $100 sales price). Applying a 20% advance rate, the borrowing base is $8.

- WIP: At this stage, $10 of costs are added and raw materials become WIP worth $50. With a 10% advance rate the borrowing base is $5.

- Finished Goods: $20 of costs are added to transform the WIP into finished goods, now valued at $70. With a 50% advance rate the borrowing base is $35.

- By the time we get to accounts receivable, we are expecting to receive $85 in cash for a $100 sale. With an 85% advance rate, the borrowing base jumps to $72.25.

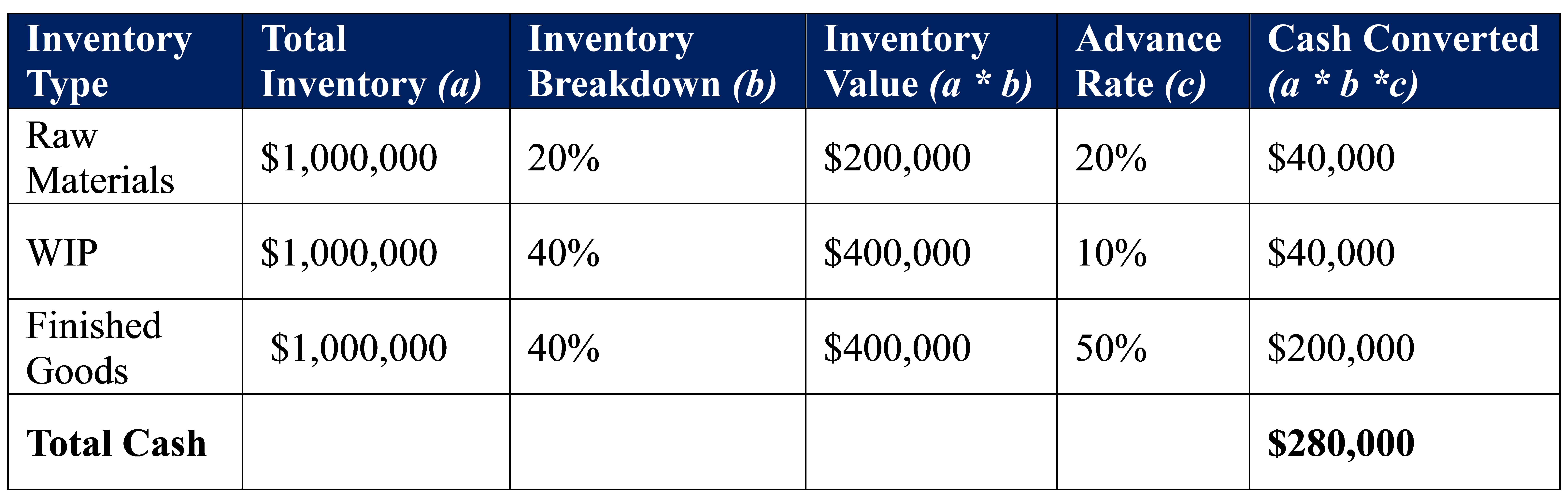

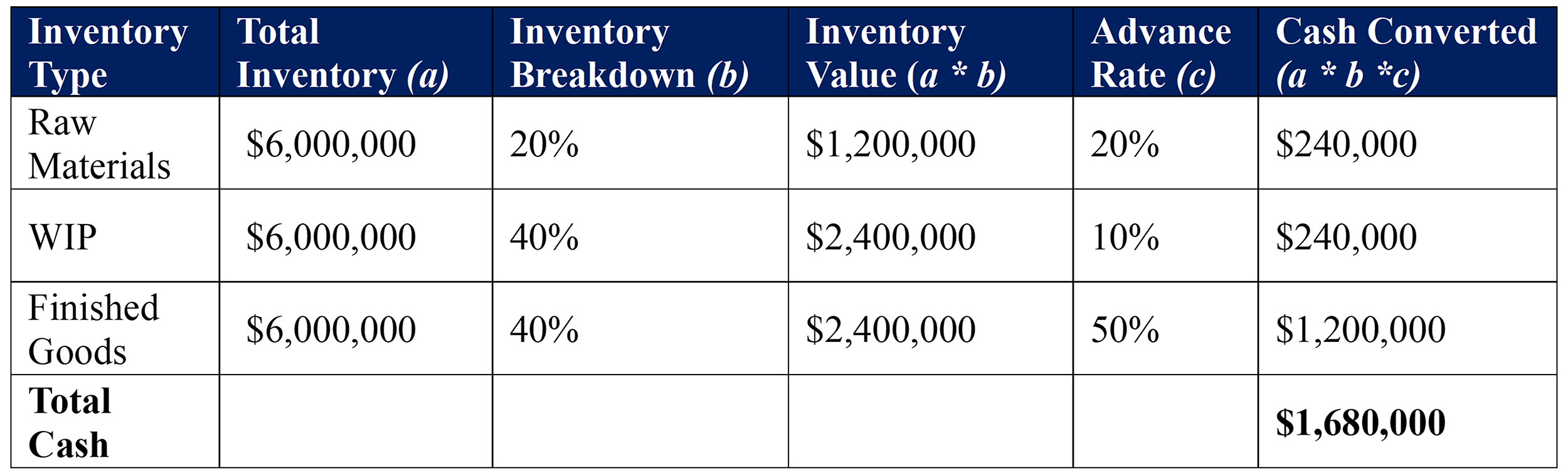

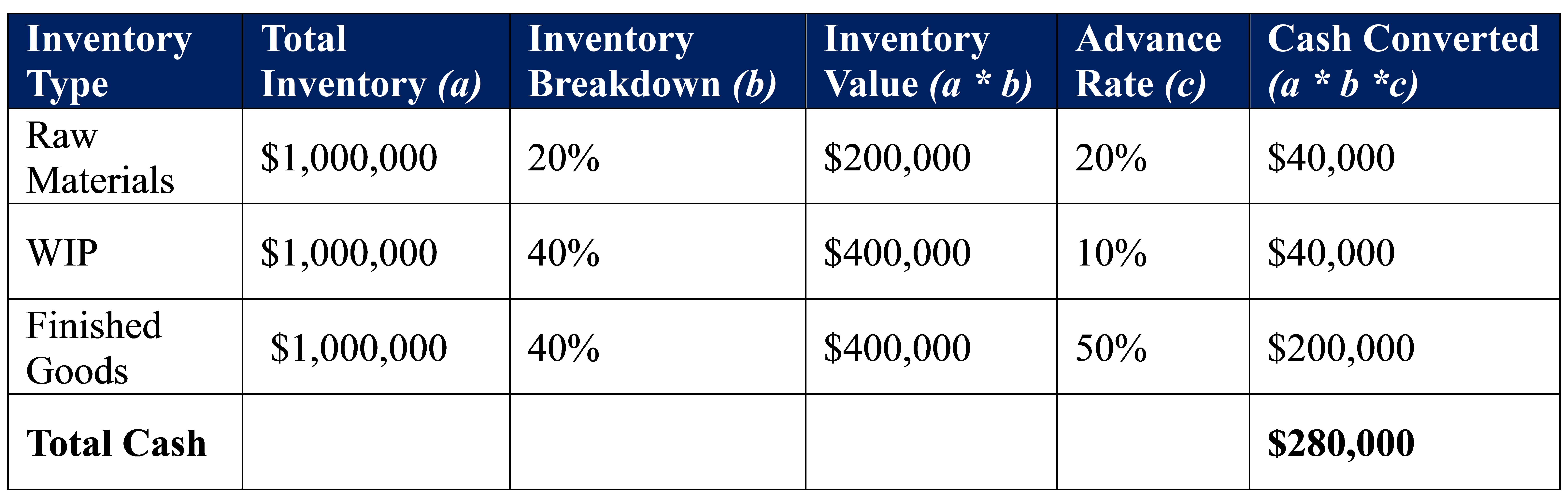

Now, suppose a company holds $1 million in inventory composed of:

- 20% raw materials

- 40% WIP

- 40% finished goods

Based on the following, and the above-mentioned advance rates, inventory can be converted into $280,000 cash.

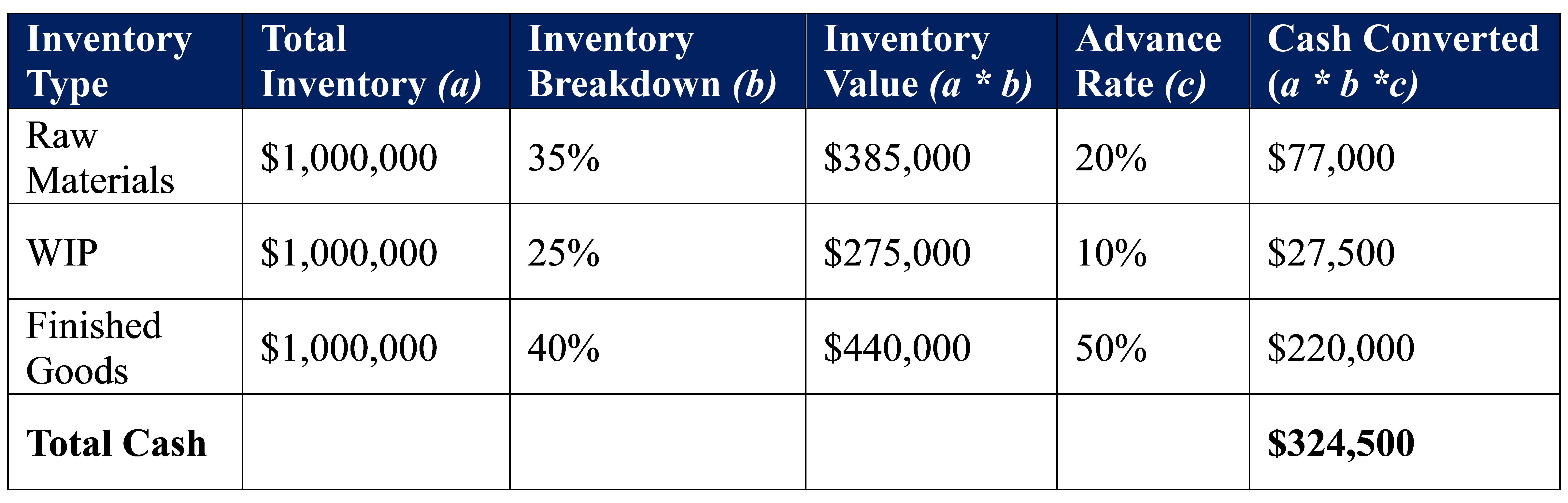

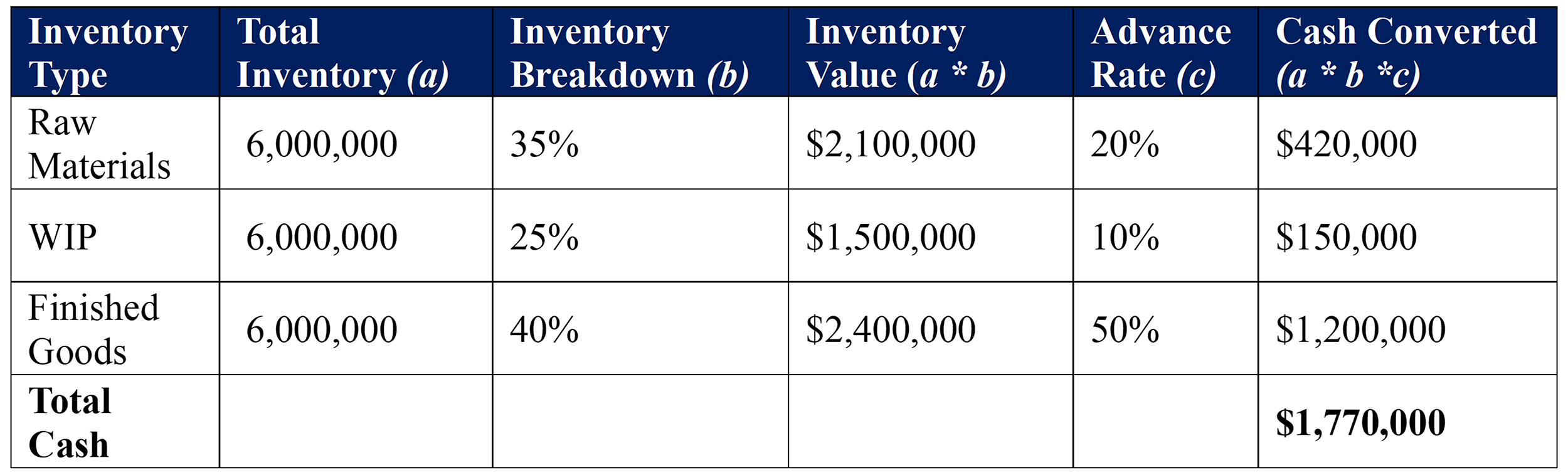

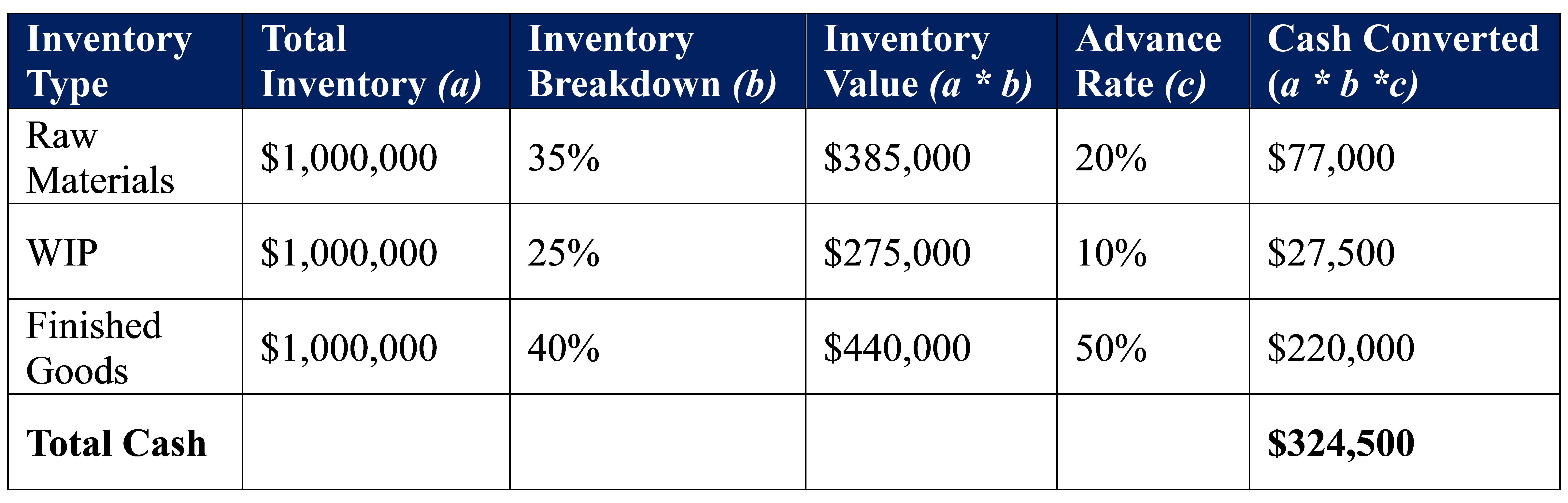

With more cash on hand, more materials may be purchased, and inventory increases to $1.1 million with the following composition:

- 35% raw materials

- 25% WIP

- 40% finished goods

The increase in total inventory allows conversion of assets into $324,500 cash.

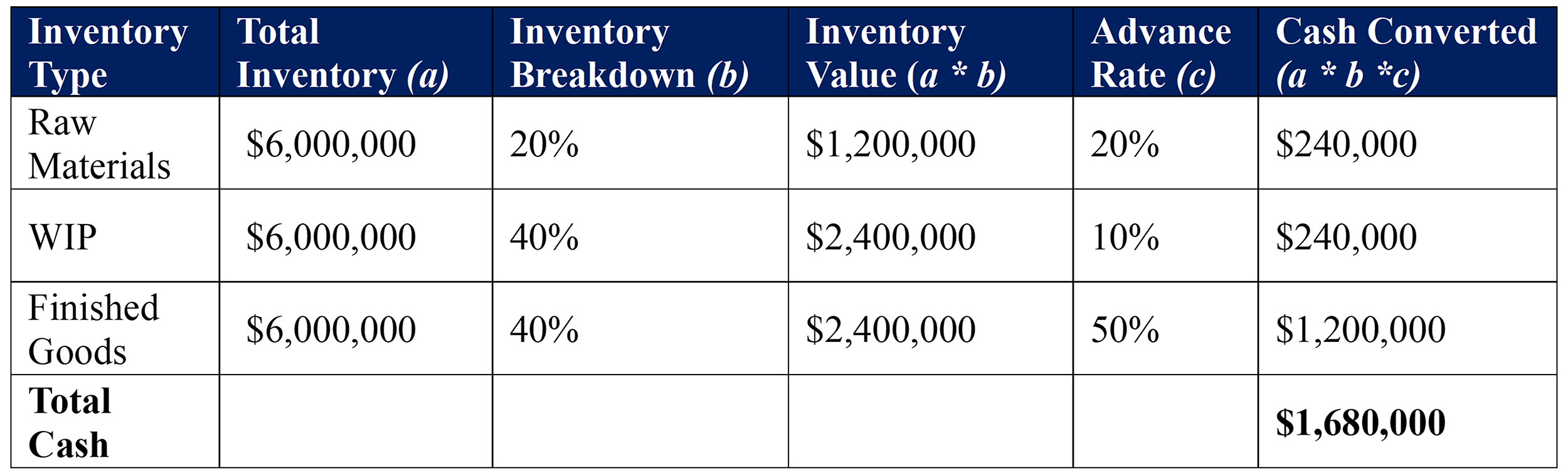

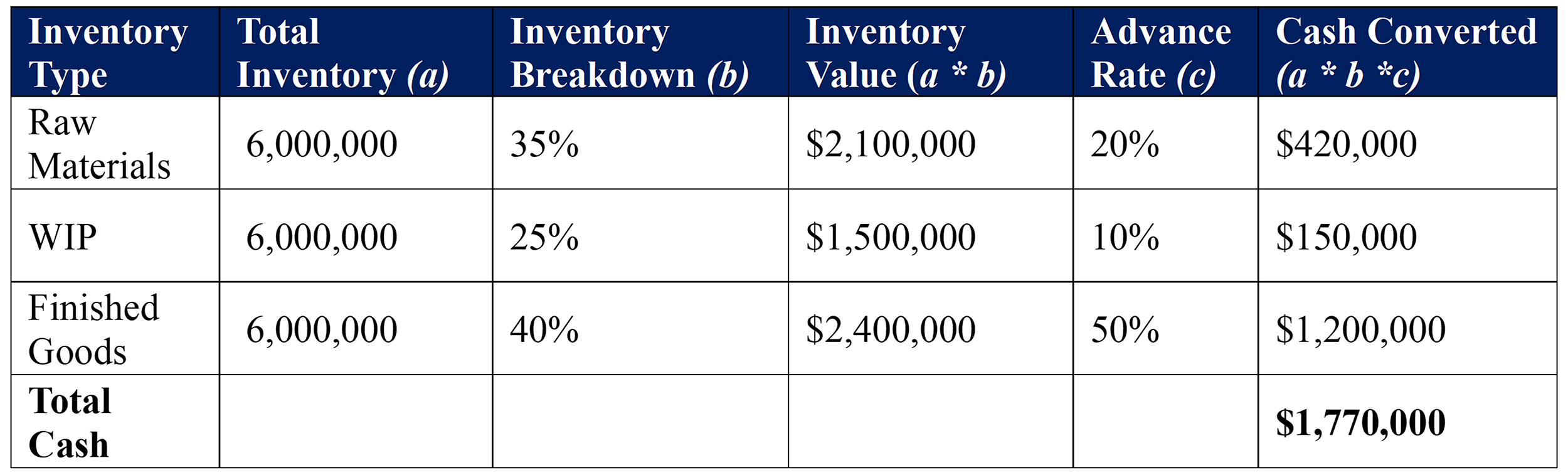

Increasing inventory value has a substantial impact on the total cash a lender would be willing to lend. This impact is further magnified when factoring in inventory turnover. If inventory turns six times per year, the original scenario will generate $1.68 million in annual cash flow, while the revised inventory would generate $1.77 million in annual cash flow. This demonstrates how both the composition and turns of inventory are critical drivers of liquidity and working capital efficiency.

The chart below illustrates the impact higher inventory turns have on potential cash conversion:

Understanding this progression is critical for managing working capital and optimizing borrowing capacity in a manufacturing or distribution business.

In some cases, shifting resources to the manufacturing process can improve liquidity. For instance, CR3 Partners recently worked with a client who had millions of dollars in WIP, which was preventing them from making payroll. We created the battle cry “ship your WIP” and started planning all company strategies around shifting resources to convert WIP to cash. By accelerating production, we turned the WIP into finished goods, which significantly improved liquidity. Similarly, analyzing what inventory can be shipped and sold, regardless of whether there are active orders for it, can generate cash.

The cycle time from raw materials to WIP to finished goods needs careful management, especially considering recent supply chain disruptions. During the COVID-19 challenges of 2021 and 2022, companies faced difficulty in securing the materials needed to fulfill orders. When supply chain issues eased, inventories swelled, putting additional pressure on traditional working capital lines.

Today, many companies are finding that their existing working capital lines are insufficient to meet the growing demands of the post-pandemic supply chain. Revolvers are designed to support short-term financing needs and quickly turn over assets. However, lenders are often reluctant to use these lines to fund long-term working capital needs, leaving companies with the challenge of finding additional, more permanent sources of funding.

Conclusion

Effectively managing working capital and collateral in revolving asset-based loans is essential for maintaining liquidity, especially during financial distress. By conducting regular audits, addressing ineligible assets, and optimizing inventory cycles, companies can enhance their cash flow and avoid running into severe liquidity shortages. In times of default or financial difficulty, it is critical for businesses to proactively manage their assets and take responsibility for their own financial health, as lenders will not provide a safety net.

About CR3 Partners, LLC

CR3 Partners, LLC is a national turnaround and performance improvement firm that assists, guides, and collaborates with management teams and their constituents facing any sort of transition, opportunity, stress, or distress. William Snyder is a Senior Managing Director and Partner based in Dallas. Miles Staglik is a Managing Director based in Los Angeles. Clara Goetsch is a Senior Associate based in Dallas.